How Do We Buy Houses Creatively in Michigan?

We are unique in that we buy houses for cash and also by using creative finance strategies. By doing so, we are able to provide higher offers than a traditional homebuyer. We understand that every situation is different and we want to provide you the best offer for YOUR situation.

CASH

A traditional cash offer is just what it sounds like – CASH! This is very straightforward. There is no commission when we buy your house and we also pay closing costs. We close with a reputable title company and you receive your cash at closing.

SUBJECT TO

Homeowners that purchased their homes in the last year or two are finding themselves in a situation where they owe as much (and sometimes even more!) than what their house is currently worth. In these situations, if they were to sell, they would have to bring money to closing.

This is where Subject To comes in; we take over the payments of your mortgage, or purchase the property Subject To the existing mortgage. This not only allows sellers to sell their home without having to come to closing with cash, but sometimes even allows them to walk away with cash at closing.

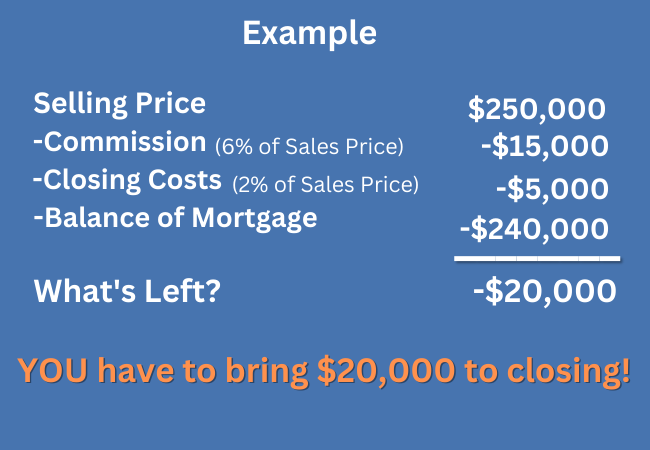

For Example: Let’s say you owe $240,000 on the balance of your mortgage. If you were to list your house for sale today, you’re hoping to receive an offer of $250,000. (And you’re crossing your fingers that the buyer doesn’t come back to renegotiate the offer after the inspection!)

At first glance, it looks like you’ll walk away with around $10,000, right? Not so fast. If you’re selling with an agent, out of that $250,000, you would need to pay commission and closing costs. In Michigan, 6% is a typical real estate agent commission and closing costs are around 2% of the sales price, on average.

Let’s look at the math:

In this example, if we were to purchase your home Subject To the existing mortgage, you would bring no cash to closing! We would take over the payments of your mortgage, there is NO commission and WE pay closing costs.

With the rising living expenses, more and more homeowners are falling behind on house payments. When we purchase homes Subject To the existing mortgage, it actually helps repair the credit of the seller. By us taking over your mortgage payments it helps rebuild your credit, with consistent, on-time payments of your mortgage. That is a huge benefit to sellers that have damaged their credit with late payments.

Seller Financing

When a seller owns a home free and clear (no mortgage), he or she may want to “become the bank” when selling the property. This can offer the seller monthly cash flow that provides a better return than fixed-income investments or even the stock market.

It’s essentially the same thing as investing in real estate, only slightly more personal. In addition, the seller can sell the promissory note for the loan to an investor for a lump sum payment at any point in time.

If you sell a property outright and don’t buy another property fast enough, you could be required to pay capital gains tax on the lump. However, with a seller finance transaction you can structure the payments over time which will defer a portion of your capital gains tax which can be more beneficial in the long-run

For example, if the seller is moving toward retirement, which could be the reason for selling the property, he can have the benefit of a structured deal where over time he receives money from the buyer every month, every quarter or however the payments are structured.

We buy houses in a variety of other ways as well. We have done novation agreements, land contracts, a combination of subject to and seller finance transactions, etc. Everyone’s situation is unique. Fill out the form and let’s discuss your situation to find a solution that is right for you!